Some say things are changing for women in business. That the playing field is leveling and it’s becoming easier for women to win in the corporate world. In 2019, venture capital funding for women-founded businesses totaled $3.3 billion. This number seems worthy of a round of applause—it’s an increase from previous years and progress toward improving equity and representation of women at the top.

Entrepreneurship among women is also on a steady incline, with women now slightly more likely than men to start a business. Yet many women, especially those in the trenches founding companies and seeking funding, may regard these numbers in a different light.

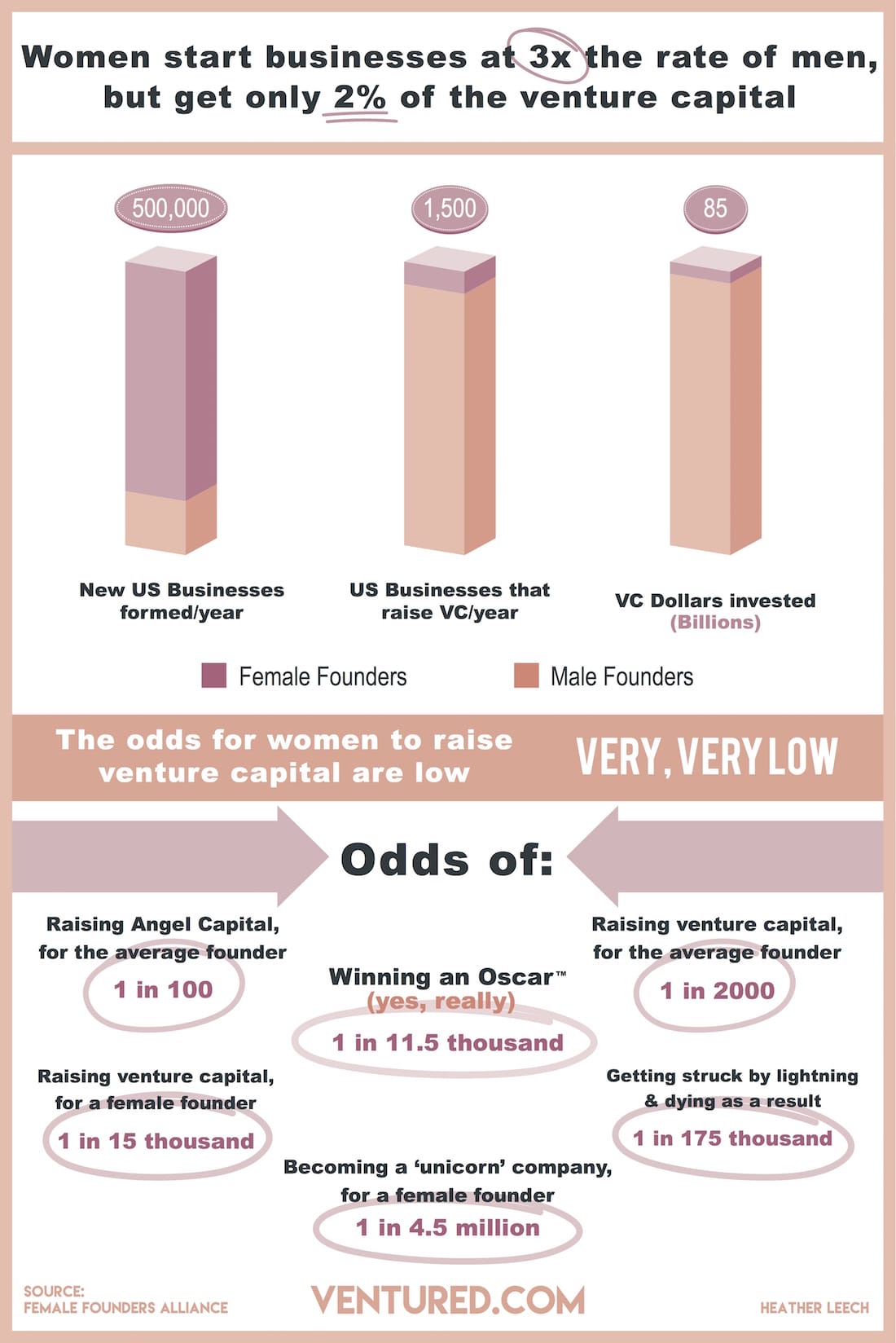

Consider the Fortune report that, “In 2018, all-female founders put together received $10 billion less in funding than one e-cigarette company, Juul, took in by itself.” Through that lens, the $3.3 billion in VC money given to women in 2019 is seen for what it really is: a meager share (2.8 percent to be exact) of the total venture capital pie.

The numbers aren’t much better at the grassroots level. While women start businesses at a rate between three and five times that of men, just slightly more than four percent of small business loan dollars are awarded to women.

The issue? Gender barriers—including the maternal wall, tightrope and prove it again biases—remain firmly and stubbornly in place across industries.

Progress or Pittance?

Leslie Feinzaig, founder and CEO of Female Founders Alliance, a startup accelerator dedicated to furthering the success of venture-scale companies led by women and non-binary founders, has dedicated years of her career to equity. She believes the VC arena has a long way to go before women achieve fair play.

“It's hard to say whether [2019 showed] true progress, especially without knowing if it's a pattern or an outlier year. With venture, late large rounds can mask the lack of earlier rounds. Similarly, progress at the earliest stages of the pipeline where the rounds are smallest is hard to track with the overall metric. I hope it's progress, and I hope it improves further.”

Feinzaig, a Harvard Business School graduate and alum of companies including Microsoft, Procter & Gamble and Julep Beauty, and one of Forbes Magazine’s 100 Most Powerful Women from Central America & the Caribbean, experienced the challenges of securing funding as a woman founder firsthand. Her experiences of seeking backing for her company Venture Kits ultimately led her to start Female Founders Alliance in 2017, with the aim of creating a more just world for girls.

The Female Founder’s Alliance website cites some startling figures regarding equity in business. A woman has a one in 15 thousand chance of raising venture capital, worse odds than that of winning an Oscar (one in 11.5 thousand); and a better chance of being struck by lightning than her company reaching unicorn status.

All this, despite the fact that companies with at least one woman founder perform 63 percent better than all-male teams, and female founders generate more than two times more revenue per dollar invested.

The Riveter

Amy Nelson, co-founder, and CEO of The Riveter, a membership community of co-working and event spaces designed to meet the needs of women, is also on the crusade to improve outcomes for women and girls. Since its founding in 2017, The Riveter has established eight locations across the Midwest, Southwest and West Coast. With more than $20 million in venture funding to date, Nelson plans to expand The Riveter to more than 100 satellites by 2022.

According to the startup, it includes Jane Fonda, Backstage Capital founder Arlan Hamilton, U.S. Senator Tammy Duckworth, and former Starbucks Executive Chairman and CEO Howard Schultz, as part of its broader, 2,000-plus member network. Nelson and her team have also secured partnerships with brands including Microsoft for Startups and Alaska Airlines.

Nelson may be one of the few women to have successfully scaled venture capital’s walled garden, but that success was hard-won. She founded The Riveter while pregnant with her third child and was caring for the newborn when seeking seed funding. She faced persistent questions—about her physical capabilities, priorities, etc.—all within the context of her being a mother.

“There is a strong bias against women who are mothers. I got a lot of questions about my baby that nobody would have asked a father. My response was that I can physically do anything. I started a company while pregnant. I knew how to deal with it and was able to do it. [Investors] need to accept that there are different paradigms than what we grew up with. You can’t count people out just because they are mothers,” Nelson said.

For Nelson, the maternal wall bias was nothing new. Previously a corporate litigator for more than a decade, Nelson had struggled to align the dynamic of motherhood with the rigidity of corporate America. She took issue with the fact that while approximately half of law school grads were women, the percentage of law firm partners was disproportionately male.

Eventually, she left law and focused on figuring out what was happening to all the other professional women leaving their jobs after becoming mothers.

“Women are inventive,” Nelson said. “I found that a lot of these women were starting companies or consultancies. Because they weren’t finding a path forward in corporate America, they were finding their own way. That was where the seed was planted.”

After research, business classes, visiting workspaces and talking to women, Nelson realized that women entrepreneurs didn’t have a dedicated place to go to find community. And that became her point—to create a network and platform for women starting businesses to collaborate and learn from each other.

Closing the Gap

Most women in the startup and VC worlds agree that to solve the problem, men and women must work together to address inherent biases, and offer a fair shot to entrepreneurs who are ready for high growth.

“Eighty-nine percent of VC investors are men. Investors should make a conscious effort to get in front of more women founders, and make the choice that they are going to meet with and talk to women founders all the time,” Nelson said.

Nelson also believes the pay gap starts with a woman’s first job and follows her through her career. She encourages women to fight for equity from day zero and choose to work with employers, partners, and investors that are doing good things for women.

Feinzaig added further advice:

“With the VC excesses of the past few years finally in plain view, the market is turning towards cash efficient, profit-focused companies that know how to grow. This is great news for female founders, who are traditionally much more revenue-ready, perhaps as a consequence of not having investment dollars available. My biggest advice is to focus on your business fundamentals—revenue, growth and customer love—and get those metrics to speak for themselves. Learn your business model and be able to explain it. And learn how to pitch your company effectively. A great business addressing a large market with a founder that knows how to communicate has much better odds of finding great investors to get behind it.”