The macaron trend took America by storm (and by the Instagram account) in the 2010s. If you want to get specific about it, according to Google, our searching interests actually peeked at the end of 2012. So what’s on the horizon for this trendy French pastry in 2020? Is it just another culinary fad à la the cupcake? Or is it just the beginning for this beautiful, blank canvas of a dessert?

Here’s a look at US spending on baked goods, new dessert industry trends that are shaping the future of these pastries, and how some of today’s major players in the macaron business are capitalizing on them.

The Macaron Industry’s Potential for Growth

We’re all aware that macarons experienced a boom across the US over the past decade, but to put that popularity in perspective, consumer reports indicate that, “The French macaron has had a 13-times increase in [market] penetration in the past 10 years.”

Basically, if you didn't know what a macaron was in 2010, you do now.

There are many reasons for their blossoming popularity. Their colorful, delicate appearance makes them perfect for sharing on social media. Their lower caloric value – only 70 calories apiece – make them a sensible dessert choice for today’s more health-conscious consumers. But are those qualities enough to sustain their success in the future? Is there room for growth in the macaron market?

The US Baked Goods Market

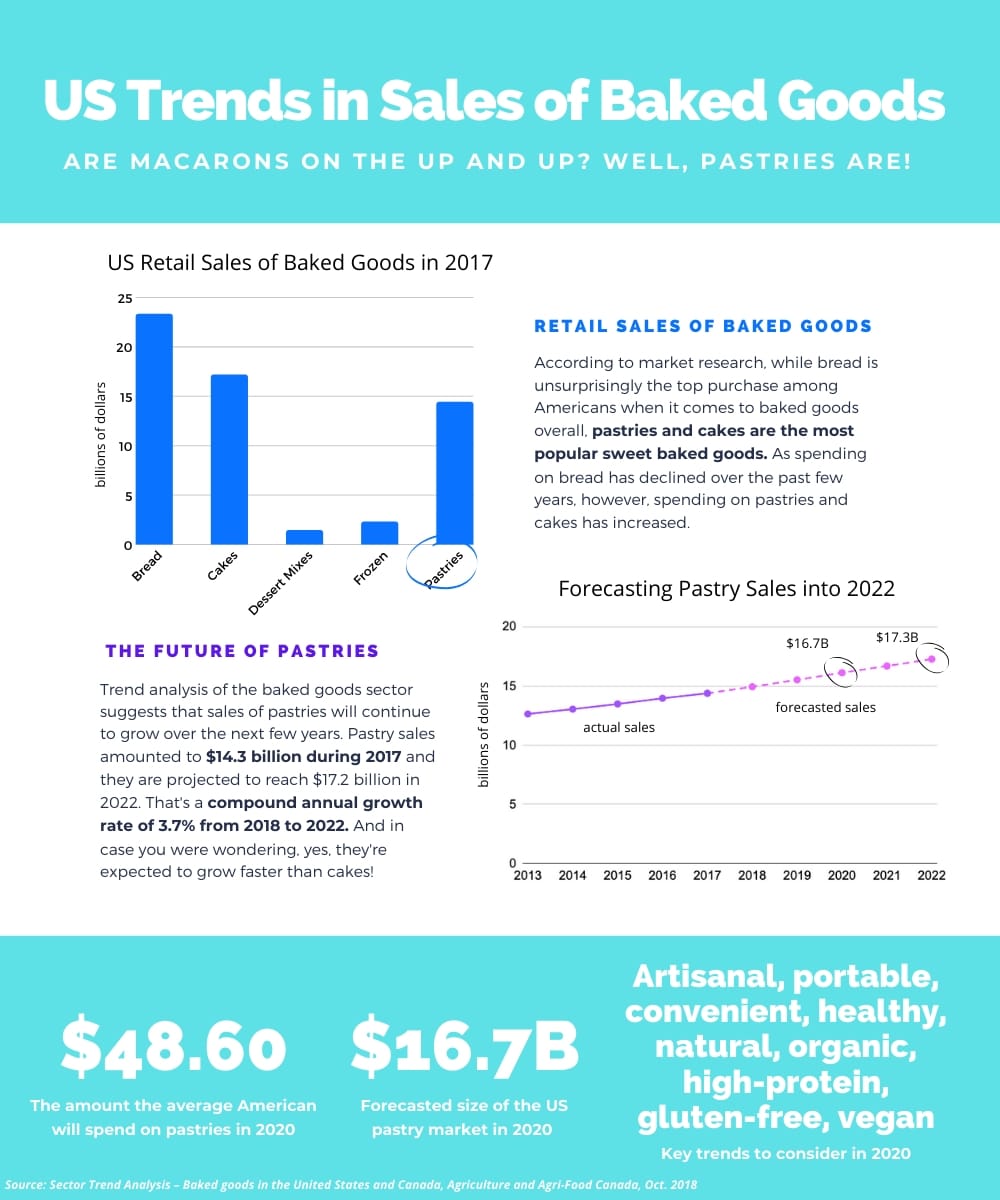

First off, let's look at the dessert industry. It's huge. Americans spent over $58.6 billion on baked goods in 2017 – more than any other country on the planet – and that’s up 1.6% from the previous year.

But not so fast. That $58.6 billion actually includes things like bread and dessert mixes, so let’s take those out of the equation.

Annual spending on the ready-to-eat sweet stuff – cakes, pastries, and frozen baked goods – amounts to about $33 billion each year. Yep, that's a lot of dessert.

To go even further, let’s classify macarons as a pastry. (It is, after all.) Pastry sales have done well over the past few years. In 2017 they accounted for a full $14.3 billion. They’re also projected to grow over the next few years, with market researchers estimating they’ll reach $17.2 billion in sales in 2022. That amounts to a compound annual growth rate of 3.7% from the years 2018 to 2022 for pastries alone.

Pastries are also flourishing compared to other baked goods in the US. While American expenditure on bread, dessert mixes, and frozen items have declined, spending on cakes and pastries increased from 2013 to 2017, and it looks like it'll continue to do so. The average person in the US spent $44.20 on pastries in 2017 and is expected to spend more like $48.60 in 2020. It's not crazy growth, but it's steady.

The Direction of Desserts in 2020

Increasing sales of pastries aren't the only reason the future of macarons remains bright. Let's look at some dessert industry trends that could benefit macarons specifically…

A Trend Toward the Premium

Remember how we said the baked goods market grew 1.6% from 2016 to 2017? That 1.6% growth in sales is owed entirely to price increases and the growing importance of premium brands. Perhaps that’s more good news for those pricey macarons and artisan, small-batch bakeries. It’s no secret that customers tend to give more value to handmade, gourmet baked goods, but this stat seems to support it.

It’s not just the hipster bakeries and luxe cafes that are responsible for a growth in premium brands. According to market research, artisanal pastries and cakes have benefited by expanding into supermarkets with in-store bakeries.

No, it doesn’t sound sexy, but here’s the thing about supermarkets: They’re able to display these baked goods prominently in glass or clear, plastic packaging to generate impulse purchases! No wonder Whole Foods has had such success with macaron sales.

Becoming More Health-Conscious

While the populations of developed countries are certainly trending toward healthier, more natural options, we aren’t tired of indulgent desserts just yet.

Today’s tastes have evolved though. Americans have historically preferred desserts like cakes, cookies, and doughnuts, but the market for baked goods has matured a lot over the years. Consumers are craving transparency about what’s included in their desserts and they’re more conscious about what they’re putting in their bodies. Health concerns, as well as a desire to eat “cleaner,” have influenced our dessert selections. People prefer fresh over-packaged, natural over artificial, and artisanal over mass-produced.

Whole Foods has had such success shows the average consumer has become much more discerning and health-conscious, and these health trends are pushing businesses to innovate as their customers choose products that follow the latest health and wellness trends. (Hey, blame Gwyneth Paltrow.)

“Permissible Indulgence” – Ever Heard of It?

Another driving force in 2020 when it comes to snacks and desserts is the idea of “permissible indulgence” or incorporating good-for-you ingredients into treats. This way, you get that gratification you’re looking for in addition to a healthful ingredient to offset any guilt you might feel.

For those who make desserts, this means finding new ways to include superfoods or ingredients that contain benefits like antioxidants, protein, or anti-inflammatory properties. For example, spices like turmeric, cumin, and cardamom have great flavors and they’re considered “beneficial additives.”

Gluten-Free, Dairy-Free, and Vegan

On a global scale, the avoidance of certain ingredients – like gluten, dairy, and animal products – and the desire to cater to food allergies is more prevalent than ever.

As of 2019, consumer reports indicate a growing interest in these types of desserts: 59% of dessert business operators offer or are interested in offering desserts with “free-from” descriptors (for example, gluten-free, dairy-free, or vegan products) while 26% of consumers are interested or very interested in this trend.

“Foodie” Culture and Global Flavors

Millennials might be accused of killing a lot of things (think cable TV and chain restaurants) but desserts aren’t one of them. This younger generation has fully embraced the “foodie” culture, and they are driving innovation in kitchens around the world.

Millennials are constantly seeking new experiences over things (this is practically their mantra), which is a large part of the foodie culture as well. More and more consumers are finding these new experiences through culinary offerings like exotic flavors and global cuisines, and that includes baked goods.

As proof that this millennial-foodie is driving dessert trends, consumer reports from 2019 indicate that about 41% of consumers are interested or very interested in global or globally-inspired desserts (and 55% of operators offer or are interested in offering them).

According to the foodservice industry, customers are becoming “increasingly receptive to cuisines and flavors from around the world here at home.” Many consumers are interested in exploring niche ingredients, different spices, and international flavors.

Convenience, Snacks, and On-The-Go Desserts

People are busier than ever these days, and accordingly, convenience has become one of the biggest trends among consumers of baked goods. Busy, hungry people are seeking out “mini” versions of desserts, single packs, portable baked goods, and “on-the-go” style snacks and desserts more than ever before.

In addition, this trend towards smaller portions and convenience-sized desserts serves a growing segment of single or dual households, older folks, and consumers who are watching their weight and/or health.

As an additional perk, snacks and desserts also provide the perfect arena for both the baker and the consumer to affordably experiment and take risks with those new and exotic flavors we mentioned.

How Macarons Square With These New Dessert Trends

So how do macarons fit in with our new health-conscious, on-the-go, gluten-free, try-new-things, premium lifestyle? Well, not to get all rose-tinted-glasses on you, but macarons are perhaps the one dessert that is perfectly tailored to the modern consumers' most sought-after values.

Which tiny, 70-calorie French dessert do you think provides the perfect palette for trying out all those global flavors? With its shortlist of simple, straightforward ingredients, the macaron can be constantly innovated and customized to reflect the flavors of any region. It can incorporate spices and unique tastes and highlight new (weird or even savory) culinary combinations.

In fact, we’ve already embraced this trend wholeheartedly. The United States has been labeled the “experimental vanguard” of the macaron-making world, where leading chefs play with exotic and regional flavors. Heck, Pharrell teamed up with Ladurée to create a cola and peanut butter macaron!

As for portability, these treats have it in spades. Macarons are perfect for today’s busy, smaller-portioned lifestyle – they’re barely more than bite-sized as it is!

Macarons also align with our newly acquired taste for the premium. The high price point of macarons reflects its value to the customer.

When it comes to the “free-from” certain ingredients trend, macarons are about halfway there. Unlike most traditional baked goods, they're naturally gluten-free because they're made with almond flour. And depending on what you fill them with, they can also be dairy-free.

Seems Like Everything is Trending Up for Macarons, Except…

Luckily for the macaron industry, these little desserts check off many boxes when it comes to what today’s consumers are looking for. There’s just one thing: This global health kick we're on.

Sure, calorie-wise, a few of them won't ruin your diet, but macarons won’t be able to dodge the complaint that they’re made with public enemy number one: Refined, white, sugar. (Actually, granulated and confectioner’s sugar are both key ingredients.)

Unfortunately, macarons can’t jump on the uber-trendy “vegan” bandwagon either because they contain egg whites. They’re meringue-based, after all. More on that below.

So what’s a pastry chef to do? Market researchers believe that pastry manufacturers will try to mimic the success of healthy, natural breads (following the demise of white bread) by offering products that feature high fiber and protein, healthy grains, organic ingredients, and gluten-free options.

Overall, the demand for cakes and pastries in the US is still high. Researchers predict growth can be expected for those bakers who adapt, make the shift, and accommodate at least of few of these new consumer demands.

How macaron purveyors will adapt remains to be seen, but unsurprisingly, Ladurée has some ideas already…

Major Players in the Macaron Industry

You can't say the word “macaron” without thinking of Ladurée, the iconic French company that basically put them on the map. Macarons have made its owner, Francis Holder, a billionaire. He’s the man responsible for transforming a small family bakery into a worldwide brand, growing his own net worth to $1.2 billion and opening over 100 Ladurée stores in the process.

His private baking conglomerate, Groupe Holder, owns three main subsidiaries: Ladurée, the famous macaron house; Château Blanc, the industrial arm with its research and development center; and Paul, the bakery-cafe chain with over 700 locations worldwide.

Exactly How Much Macaron Money Are We Talking?

Groupe Holder’s estimated annual revenue is more than $1 billion with estimated net profit margins of 14% according to Forbes.

But exactly how much of that cash is owed to these delicate, colorful pastries? Holder himself estimates that about 60% of the conglomerate’s in-store sales come from macarons. In the whole of France, Groupe Holder is responsible for the top three macaron sellers: Ladurée, Paul, and – surprise, surprise! – McDonald's. (Hey, who says the French are always fancy?)

To get an idea of how much cash these huge macaron houses are raking in, consider the second-biggest name in macarons, Pierre Hermé. From 2010 to 2015, his sales grew fivefold, rising to $54 million.

In 2015, Pierre Hermé received investments from cosmetics group L’Occitane to help expand his luxury brand into North America and China. Known for his crazy flavor combinations and cafes inside of stores like Dior, Pierre Hermé now has over 55 locations worldwide.

Reuters noted, “This deal is the latest sign of growing investor interest in luxury food, which has been enjoying solid growth, buoyed by local and tourist demand.”

So how did these successful macaron companies take the notoriously finicky, labor-intensive dessert beyond the borders of France, into the realm of fast food, and beyond? How exactly does one make millions off of desserts?

Scaling the Macaron

Long before the macaron trend exploded, Ladurée saw the dessert’s mass-marketing potential and invested heavily in automation, to the tune of 80 million euros. While refusing to compromise on their artisanal quality, Château Blanc built the first-ever automated macaron production line.

They now have three factories that supply frozen macarons to customers like McCafé, Paul, and yes, Ladurée locations outside of France.

Hearing the truth about how those expensive little gems arrive on your plate can be shocking, but the quality is still there. According to one Ladurée spokesperson, “We don’t say they are frozen — it’s not a very pretty word. We say they are in hibernation.”

Pierre Hermé does the same thing. According to him, “Any pastry chef who says he doesn’t freeze his macarons is a liar.” He makes his macarons in a factory in Alsace and ships them frozen within France and internationally to London, Hong Kong, Tokyo, Dubai, and Doha.

Don’t worry, you can still find bakeries out there who lovingly make your beloved macarons by hand. For example, small-scale Parisian baker Arnaud Delmontel is able to turn out 3,000 macarons per day with only two men in the kitchen. In comparison, however, Ladurée’s 100,000-square-foot factory with conveyor belts the size of football fields can make 30,000 macaron shells per hour.

Franchising the Macaron

In the US, the owners of bakery-cafe chain Le Macaron have found another way to scale and increase profits through franchising. French ex-pats Rosalie and Audrey Guillem began with a small boutique patisserie in 2009, and by 2017, they had opened their 50th store.

As of 2018, Le Macaron was reporting $11 million in annual sales.

Franchising the Le Macaron brand name became a huge business opportunity, particularly for other French immigrants coming to America.

For $30,000, managers can obtain franchise rights, and then they begin paying 6% of weekly earnings to the owners. Le Macaron estimates that the total investment for franchisees is somewhere between $126,000 and $353,000 for space rental, equipment, products, and staff.

If you're trying to get in on this business model, don’t worry, you won’t even have to bake your own macarons! Le Macaron has standardized its baking process as well. They have 15 artisans (including a few French pastry chefs) producing 15,000 macarons each day in Sarasota, Florida. They ship the macarons by refrigerated truck to franchises all around the US.

Mobilizing the Macaron

Remember how we said portability was going to be a big trend in 2020? Well, Le Macaron is already on it. While they sell 20 flavors of multi-colored macarons in their cute boutiques, they’ve also expanded the concept to mobile kiosks.

According to Rosalie Guillem, “[W]e introduced a new, nontraditional franchise opportunity in the form of a mobile food cart. We wanted to create something out of the ordinary, and this is a great way for us to keep up with the on-the-go lifestyle and capitalize on audiences at malls, sporting events, festivals and other gatherings…”

Trend-wise, it sounds like they've hit the nail on the head. For those who are interested, a mobile macaron cart is a much smaller investment, somewhere between $91,000 and $127,000.

Another macaron company has already proven the validity of this mobile concept. After opening a pop-up shop in New York City’s Bryant Park in 2012, the macaron brand Woops! did $200,000 in sales in just nine weeks. In 2015, they began franchising the concept and expanded from 15 to 33 locations. In 2017, they focused their expansion on mall kiosks, noting that upscale malls have excellent foot traffic.

Vegan-izing The Macaron

You knew it would come to this.

“Vegan” was big in 2019 and with more consumers than ever choosing to go 100% plant-based, it’s still very much a trend for 2020 and beyond. As restaurants rush to create menu items for vegans, bakeries have joined them.

But when it comes to macarons, Ladurée is leading the way in – where else? – California.

At the end of 2019, the French brand announced that they’ll go fully vegan in their Beverly Hills shop, with more locations to follow. Famous plant-based chef Matthew Kenny will take the reins on this project. And no, we have no idea what they’ll be using in place of egg whites…

And as if capitalizing on one big 2020 trend wasn’t enough, this Beverly Hills Ladurée will also be offering up superfood macarons – with flavors like hemp, green tea matcha and moringa, and almond lucama – and they’re selling them in new, eco-friendly boxes made without plastic or glue.

Come On, Isn’t The Macaron Trend Slowing Down?

Sure, we’ve gotten used to seeing these colorful sweets around, but that doesn’t mean we’ve lost our taste for them. Despite rumors that luxury eclairs were taking over a few years ago, they’ve yet to reach the heights of macarons or even detract our attention away for too long.

This isn't like the cupcake or the cronut trend. The initial hype may have worn off our favorite French pastry, but the macaron has persisted. According to the Washington Post, “Macarons may not be trendy, but they’re still très chic.”

Writer Maura Judkis explains, “[L]iking macarons isn’t really about baked goods. They’re a social signifier, like a Hermes bag or a Louboutin pump.”

Entrepreneur asked Woops! co-CEO Raj Bhatt if he was afraid the macaron trend was dying down. His response? “I’m always worried about trends. Everything has a shelf life. But in New York, where macarons have been around a long time, we’re continuing to do very well. Outside the big cities, we find that people still don’t know what macarons are.”

So Is There More Money to Be Made in Macarons?

While we don't have sales data specific for macarons, market research firm Euromonitor International predicts that baked goods as a whole have a bright future due to the sector’s increased investment in innovation and the ability to offer higher quality and fresher, more elaborate desserts.

What's the rationale behind the staying power of the macaron? There's something intangible about it, something special, regardless of the latest dessert trends.

“It’s timeless,” says Elisabeth Holder Raberin, the owner and chief executive of Ladurée US. “Hopefully, I think it will stay forever.”