Putting your retirement fund or kid’s college fund in the hands of a company is a decision that no one takes lightly. It requires a lot of research and careful consideration. Still, finding the right financial manager who can help you fulfill your financial goals is not the easiest thing to do.

Thankfully, that is what this article aims to solve. One of the newer investment vehicles or financial managers is Robo-advisors, wealth management services that use machines to help clients safely and easily invest funds.

Robo-advisors offer significant benefits over their traditional counterparts. For one thing, since they are machines, they do not require payment, so the typical cost associated with investing is lowered. Also, using Robo-advisors means you will be saving a lot of time for all the parties involved in the investment process.

This Wealthfront and Ally Invest Review looks at two of the leading Robo-advisors available on the market. These are two of the most widely used Robo-advisors today, but they are very different companies created for different investors.

Still not sold on Robo advisors? Find out how they differ from financial advisors.

What is Wealthfront?

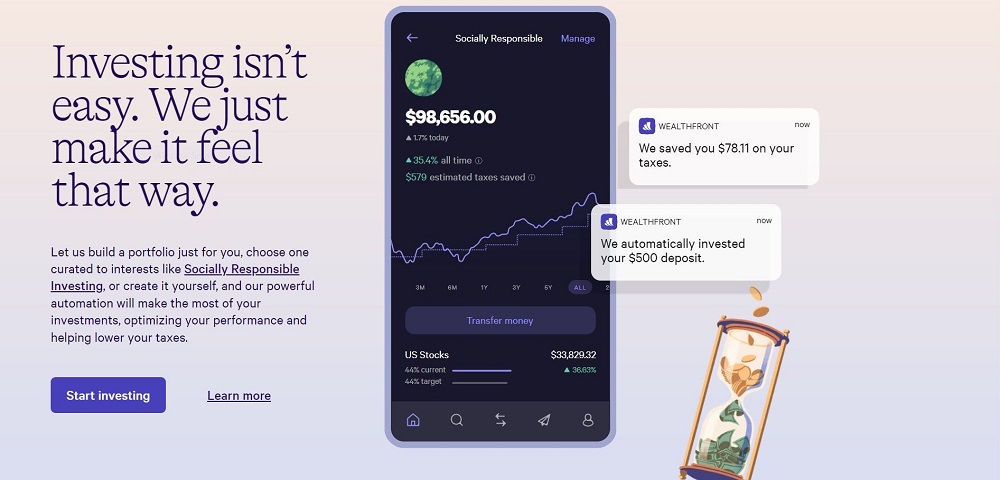

Wealthfront, over the years, has created a lasting presence in investing since it pivoted from a mutual fund analysis service to a wealth management service back in 2012. Its Robo-advisor was one of the few early birds to hit the market, making the company one of the leading names in automated wealth management.

Wealthfront has more than $20 billion in assets and offers innovative solutions and competitive prices to attract new investors.

What is Ally?

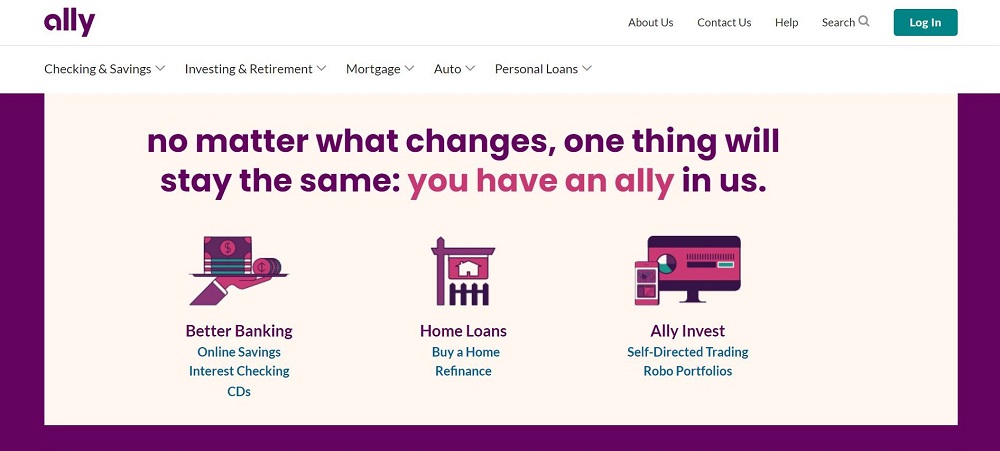

Ally Financial, which previously traded under the GMAC Inc. name, has quite a long history. Its history dates back to 1919 when it was established by General Motors.

This version of Ally today runs as a bank holding business that offers various financial services. However, it is mostly renowned for its online brokerage and banking.

In 2016, Ally purchased TradeKing, a move that enabled it to create Ally Invest brokerage and Robo-advisor services. Soon after, the company became one of the most renowned brokerage services in the country.

Wealthfront vs Ally: Planning and Goal Setting

Choosing to invest a lot of money without a concrete plan is never a great idea. And this is why financial advisors tend to put systems in place to help investors set goals before they can even invest.

Just as with various Robo-advisors, both Wealthfront and Ally provide a comprehensive and fully digital yet simply planning system that can help new customers plan effortlessly and quickly.

Wealthfront

Wealthfront has developed a financial planning system that combines flexibility and accessibility called Path.

Path enables new users to create a strategy by entering multiple variables, such as your yearly expenses, desired income, age, and more. The Path dashboard recommends a strategy while also showing a projection of how the plan would look in the future. If you are not pleased with the strategy, you can change it until you get a projection that suits you.

Once you finish the initial setup, the next step is to deposit your money, and the service will automatically invest it according to your strategy. This brings you a step closer to your financial goals.

In all, Wealthfront provides you with superior analysis that requires no effort on your path. Since the service assures customers of effectiveness and accessibility, Wealthfront has gained a reputation as one of the top Robo-advisors in the nation.

Ally Invest

Many people tend to choose Robo-advisors because they are easily accessible, especially for new investors. The Robo-advisor service offered by Ally is no different. It offers clients a simple but effective planning system that just about anyone can understand.

To create your strategy on Ally, you will be asked various questions concerning your long-term goals. You have the option to choose one out of five management strategies based on the answers you provide. These strategies range from low-risk investments for conservative investors to aggressive growth for high-risk investors.

Typically, your strategy will fall into one of the following risk categories:

- Conservative

- Moderate

- Moderate Growth

- Growth

- Aggressive Growth

A conservative portfolio management strategy is solely designed to preserve your money instead of focusing on growing your funds. On the other hand, choosing the aggressive growth option has the potential to generate significant profits in the long run.

What is great about Ally’s robo portfolio system is that it is easy to use, and if your investment goals change, you can alter your risk appetite at any time. Additionally, these portfolios are designed by expert investment managers to suit the wishes of most investors.

Thinking of investing but not sure of what strategies to use in times of uncertainty? Here are investment strategies you might want to consider.

Wealthfront vs Ally: Fees and Pricing

Robo-advisors are a lot cheaper than the services of a traditional financial advisor. However, they do come at a cost. The largest expenses a Robo-advisor client has to worry about are the management fees and the taxes owed to the government.

Nevertheless, both Ally and Wealthfront offer banking solutions and other services that can improve the overall growth of a portfolio.

Wealthfront

The company prides itself on offering a seemingly competitive 0.25% yearly management fee, coupled with tax-loss harvesting and advanced investing strategies. One such strategy is direct indexing.

Instead of simply purchasing a range of ETFs or index mutual funds, Wealthfront simply creates a bespoke index, purchasing individual stocks, which in turn, have fewer taxes on them compared to mutual funds or ETFs. This can help you save money in the long run.

To get this full range of advanced investing services and tax-loss harvesting, you will need to have a portfolio with a value of at least $100,000. However, just about anyone can still get the basic tax-loss harvesting program. Additionally, the proven investment methods should provide you with a decent return for your money.

To join Wealthfront, you need to make a minimum investment of $500, which happens to be one of the lowest minimum initial investment fees out there.

Ally Invest

Ally also offers tax-loss harvesting services to increase returns. It has an automatic portfolio rebalancing service that lowers the associated risk for its users. Unlike Wealthfront, which requires a $500 investment balance, Ally only requires $100, making it one of the easiest Robo-advisor services to invest with.

Similar to many Robo-investors, Ally purchases ETFs for each user’s portfolio. Additionally, the company is more suited to ETFs due to its knowledge. The expense ratio for ETFs provided by Ally ranges from as low as 0.10% to 0.17%, and although this is competitive, it is still a bit weaker than what Wealthfront offers.

Ally Robo-advisor customers can leverage something that other companies do not have: an online bank. Having an investment advisor and online bank under one virtual roof can be extremely handy. This is especially the case when services such as a quick loan or a debit card to spend your earnings are required.

Since Ally Invest is integrated into the main Ally Bank, customers, particularly conservative investors, are entitled to a special discount. For example, if about 30% of your portfolio is held in a traditional savings account, Ally will void the monthly management fee of 0.3%. This comes down to the fact that Ally is a bank as well, so your cash is given out as loans, which also makes a profit for the bank.

You might wonder that the whole point of investing means putting your money to work, and saving it doesn’t really do that much. It turns out that placing 30% of your funds in cash doesn’t yield a higher return if you kept the same amount in a conservative portfolio.

Conversely, you could choose to use one of the aggressive Ally Invest managed portfolio options to grow your money. If you do this and still place 30% of your money as cash, you end up slowing down your growth.

Conclusion

Wealthfront is as different from Ally as it can be. It focuses on providing automated investing, offers improved cost reduction features, and prices than what’s obtainable in the market. The planning stage before investing requires more time and thought when compared to others, but it also allows for a lot more flexibility. This enables you to create a portfolio that truly works for you.

On the other hand, Ally is created to meet the needs of clients who want a simple investment journey. The goal is to produce tangible results at the year’s end. What is great about Ally is its integration with a lot of its other services.

For example, if you decide to handle things yourself, you can seamlessly transfer your funds and portfolios to the brokerage section of Ally and even use the Ally bank.

In all, the company and service you choose mostly come down to personal preference. Wealthfront offers improved planning capabilities and prices, while Ally is designed to run as effortlessly and smoothly as possible.