If you’re wondering how to start a business in Maine, we’ve put together a step-by-step guide to help you.

Maine offers great scenery, snowy winters, and a high quality of life. It also offers a challenging business environment. It’s possible to start a profitable business in Maine, but you will need to do extensive planning. Just follow this step-by-step process outlined below.

Table of Contents

- Before starting your business, check regulatory requirements.

- Choose the kind of business you want to operate in Maine.

- Choose a unique name for your business and create your Maine business entity.

- Get your Employer Identification Number (EIN).

- Set up bank and credit accounts.

- Take out business insurance.

- Get your Maine tax-exempt number.

- How much does it cost to start a business in Maine?

Before starting your business, check regulatory requirements.

Government regulation is a reality for businesses in every state. Still, in Maine, the costs of meeting (and failing to meet) state licensing requirements can be a significant part of doing business. Anyone starting a new business in Maine needs to know which state licenses will be required and how much it will cost to qualify for them.

Maine Business Answers provides an online tool that creates a checklist of licensing requirements for every kind of business regulated by the state. It’s essential to check with this site when you are planning your business. Don’t just use the list it generates only as a list of licenses you must obtain.

Research licensing requirements to make sure you can afford any training costs or capital expenditures those licenses will require. And don’t overlook the fact that the licenses you need may be expensive.

Businesses in Maine also need to comply with local regulations, including licenses, building permits, and zoning clearances. Check with the town or city (or parish, if you are operating a rural business) early in your business planning to make your budget for the cost of compliance with all local regulations.

Choose the kind of business you want to operate in Maine.

Entrepreneurs can run their Maine businesses as sole proprietorships, partnerships, limited partnerships, limited liability companies (LLCs), limited liability partnerships, or corporations.

LLCs and corporations can file elections with the Internal Revenue Service to be taxed under Subchapter C or Subchapter S of the Internal Revenue Code, but this choice is made after the State of Maine charters the

Claiming potential tax breaks offered by Subchapter S does not require the approval of the state. The kind of business entity you choose to create determines the type of name you can use for your business. Therefore, you must choose among these options before deciding on a name.

Taxes will vary depending on the type of business you choose

1. Sole proprietors and Partnerships

Personal income tax rates in Maine range from 5.8% to 7.15%. Sole proprietors and partnerships pay Maine taxes at personal income tax rates. Sole proprietors will compute business profit and loss on Schedule C with their personal income tax returns.

Partners will get a K-1 from the partnership after it files its Form 1065, and then enter those amounts on Schedule E on their personal tax returns. Both ways of running the new business result in taxation at personal income tax rates with the ability to take deductions allowed to individuals.

Another important consideration: Neither sole proprietorships nor partnerships receive the protected status available to limited liability companies and corporations.

2. LLCs

Forming a limited liability company (LLC) offers protection of personal assets from debts and actions by the business. Owners of LLCs who do not take advantage of the option of having their businesses treated as Subchapter C or Subchapter S corporations by the IRS pay tax on their Maine income at personal income tax rates.

But if you take advantage of possible breaks on your federal taxes by making an election to have your

These rates range from 3.5 percent to 8.93 percent. The value of federal tax breaks for corporations will almost always exceed the additional taxes you will owe the State. This is something you need to compute before choosing corporation status for taxes on your

3. Corporations

Any business chartered as a corporation by the State of Maine, whether it is a C corporation or an S corporation, pays state income taxes at the 3.5 to 8.93 percent rates. Corporations, like LLCs, shield personal assets from claims on the business.

Taxation is not the only consideration in choosing the kind of business entity you will create. Sometimes protection from personal liability is sufficient consideration to decide to form an

Choose a unique name for your business and create your Maine business entity.

In Maine, choosing a name is part of the process of registering your business with the state.

Naming Requirements For Sole Proprietors and Partnerships

The State of Maine does not require sole proprietors or partnerships to register the names of their business if they choose to do business under their legal names.

For instance, Johnny Joe Jones could do business as “Johnny Joe Jones,” “Johnny Jones,” “Johnny J. Jones,” or “J. Joe Jones” without filing a Certificate of a Sole Proprietor (Individual or Married Couple) Adopting a Name Other Than Their Own. But if Johnny Jones wants to operate as “Johnny Jones Auto,” then the business must file for the certificate.

Business (or “fictitious”) name certificates for sole proprietors and partnerships are filed with the town or city clerk in the parish where you intend to do business. Most towns and cities charge just $10 to file the certificate, but there is a $5 a day fine for operating a business under a fictitious name without filing the certificate first.

This simple procedure is all you need to do to create your sole proprietorship or partnership in Maine. However, you will still need to have all your business licenses before you begin operation.

Naming Requirements for Maine LLCs

If you are planning to operate your business as a limited partnership, limited liability company (LLC), or corporation, you will register the name of your business at the time you file the paperwork to create your business with the state. The standard for names of these kinds of business entities in Maine is “distinguishable upon the record.”

If the state has issued

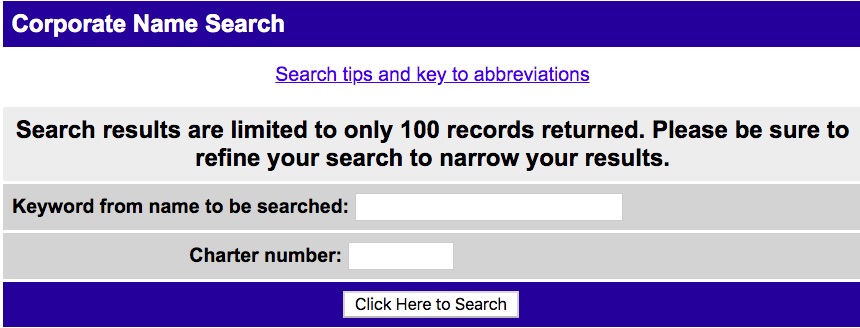

The Maine Secretary of State has an online system to check for names in use. Because this system will list a business name as available if an

After choosing the name for your

How To Create An LLC In Maine:

1. Make sure the name of your LLC includes “limited liability company” or “limited company,” or the abbreviation “LLC,” “L.L.C.,” “L.C.,” or “LC.”

In Maine, it is also possible to form a “low-profit

2. Appoint a registered agent.

This is someone who has a physical address in Maine and is available to receive the service of legal documents. If you live in Maine, you can be your own registered agent. Just be sure to list your name and address on your Certificate of Formation and then write in your street address as the registered office. You can also choose from a list of commercial registered agents serving businesses in Maine.

3. File a Certificate of Formation (MLLC-6) with the Maine Secretary of State.

You must file this form by mail. There is a $175 fee for filing this form.

4. Create an operating agreement for your LLC , even if you are the only owner of your business.

The State of Maine does not require new LLCs to have operating agreements, but an operating agreement can help you defend your

This operating agreement should list the following:

- The members of your

LLC , their rights and responsibilities, their voting powers, and the formula for allocating profits and losses. - How will the

LLC will be managed and procedures for taking votes among the members? - The procedure for allocating assets if a member wants to sell their part of the

LLC , dies or becomes disabled.

The best time to create your operating agreement is at the same time you file your Certificate of Formation.

You are not required to use your

To create a corporation in Maine:

1. Make sure the name of your corporation includes some variation of “Inc.,” “Incorporated,” or “Corporation.”

2. File Articles of Incorporation with the Maine Secretary of State online or by mail.

Maine has a form for Articles of Incorporation. You are not required to have an attorney write them for you. There is a $145 fee for filing your Articles of Incorporation.

3. Start a corporate records “book.”

This is a binder where you keep all the crucial records of the corporation. These records include Articles of Incorporation, Bylaws, stock certificates, stock certificate ledger, stock certificate stubs, stock transfer documents, and meeting minutes.

4. Choose at least one member of your board of directors.

If you are the sole owner of the corporation, this director can be you.

5. Issue stock certificates.

6. Decide on Subchapter S status.

You should not opt for Subchapter S status if you are planning to do an initial public offering (and IPO), or if your corporation includes foreign partners who are not US residents.

If you intend to retain profits instead of distributing them, you should also not file for subchapter S.

All newly created Maine corporations are C corporations until they make an election to be treated as S corporations by the IRS.

Get your Employer Identification Number (EIN).

No matter what kind of entity you choose for your business, you need a new Federal Employer Identification Number (EIN, or sometimes spelled out as FEIN). You will use this number when you file payroll tax returns. You also will use this number to establish business accounts that are clearly separate from your personal accounts with the IRS, with banks and lenders, and with the state.

Why is getting an EIN so important? In Maine, courts are particularly prone to “piercing the corporate veil.” They often hold individuals personally responsible for debts and legal liabilities of the businesses when business and personal activities are not kept separate, and when business and personal funds are intermingled.

The courts are especially inclined to enforce judgments against a business on an individual when there is “thin capitalization,” that is, a minimal amount of money was invested at the beginning of the company.

Getting an EIN won’t protect you against having to pay judgments against your business with your personal funds, but not getting an EIN makes it highly likely that you will if you are sued and lose.

It’s not hard to get an EIN. You identify yourself with your social security number (SSN). If you are not a US citizen, you can use your Individual Taxpayer Identification Number (ITIN). You can apply for an EIN online if you have never obtained an EIN with your SSN or ITIN before. The IRS will issue you a new EIN immediately.

If you have used your SSN to apply for an EIN online before, then you must apply on Form SS-4 and supply the IRS with a paper copy by fax or mail. Some services will take care of this step for you, usually for a fee of $247.

Set up bank and credit accounts.

Once you have an EIN, you can set up bank and credit accounts for your new business. It’s always a good idea to establish separate accounts for your business and to avoid using your business accounts for personal purchases.

If you need to make a non-business purchase with earnings, withdraw from your business account into your personal account. Then you can make the purchase with the funds in your personal account. Failure to maintain separation of business and personal accounts can nullify your

Take out business insurance.

Choosing the right business entity won’t compensate you for losses from fire or theft. Choosing the right business entity won’t pay your court costs when you’re accused of being negligent or doing something wrong. Every new business needs an appropriate level of business insurance.

In Maine, your business can be found “jointly and severally liable” for damages if you are successfully sued. If you don’t have business insurance, you can wind up paying the entire judgment for an act for which you are only partly responsible.

Get your Maine tax-exempt number.

A tiny number of kinds of for-profit businesses are exempt from sales and use taxes in Maine. The State of Maine maintains a list of exempt entities. Even if your business is on the list, your tax-exempt number is not the same as your EIN. You have to get a separate tax-exempt number by applying to the state.

This sounds like a lot of work. Wouldn’t it be better to create my business in Wyoming (or Nevada or Delaware)?

Thousands of new business owners set up LLCs and corporations in “business-friendly” and low-tax states like Delaware, Nevada, Texas, and Wyoming. But if you plan to operate your business in Maine, and you want to form an

Here are the reasons why:

- If your business is run in Maine, but you aren’t incorporated in Maine, you will still have file paperwork and pay fees to operate as a “foreign corporation.” You will need to file Form MBCA-12 and pay $250 for the authority to operate your business created in another state.

- If you run your business in Maine but are not incorporated in Maine, you have to maintain registered agents in both states. This means you can get sued in both states, not just one.

- If you are registered in two states, you pay annual fees and file annual reports in both states. In Maine, the filing fee for your annual report on Form MBCA 13 is $85 if you are incorporated, or your

LLC was formed in Maine and $150 if you were incorporated or yourLLC was formed outside of Maine. - Incorporating outside of Maine will not lower your state taxes. You will still pay taxes on any income you earn in Maine to the State no matter where you’re incorporated.

How much does it cost to start a business in Maine?

Answer: You can start a business in Maine for as little as $500

The process of forming a new business in Maine is relatively complicated, but the cost of formation is lower than in many other states. Registering a sole proprietorship, partnership, limited liability company, or corporation can be done for as little as $500 — or less — in city and state fees.

Reserving names for your business while deciding what to call it and using services to expedite state and IRS filings can run up your expenses another $1000.

Business licenses, business insurance, and website design will account for most of your startup budget. These expenses aren’t much higher in Maine than they are in other states, but usually range from $2,500 to $10,000.

The Maine Small Business Development Center (Maine SBDC) and the Service Corps of Retired Executives (SCORE) offer free advice to new business owners seeking the best value for their start-up expenses.