Both Betterment and Fidelity offer similar services on the surface. When you sign-up, both companies assess your risk tolerance and help you decide how long you should contribute to your account.

You can also open a retirement account with both Robo-advisors without having to fund it, at least not immediately. The portfolio consists of low-cost funds that follow Modern Portfolio Theory (MPT) principles for risk and diversity.

Learn how you can prepare your portfolio for a recession here.

Betterment Vs Fidelity: Setting Goals

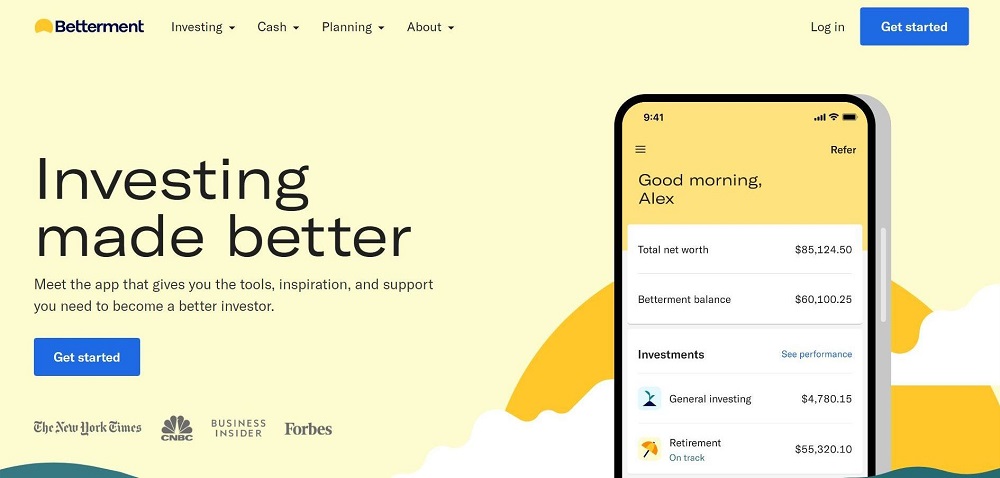

Betterment

Betterment provides easy steps to set investing goals and lets you monitor each of the goals individually, enabling you to set up several goals with varying target dates.

As a user, your asset allocation is displayed in colored circles, with the equities taking a green shade, while fixed incomes appear in blue.

Fidelity

Fidelity doesn’t offer as much goal tracking as Betterment. You can only track one goal per account. However, it is possible to get around this by creating various accounts. This is suitable for those who want to set funds aside for various goals.

When your account has been invested, you can choose the amount you want to reach by your target date. This factors in your initial deposit as well as your monthly contributions.

If it appears that you might not be able to achieve your investing goal, Fidelity will offer suggestions on how you can improve your overall success.

If you have more than one account, Fidelity allows you to view all of your accounts on one screen.

Betterment Vs Fidelity: Portfolios

Betterment

Betterment offers five different types of portfolios to choose from. These are all designed using the Modern Portfolio Theory principles, which are:

- Standard portfolio of globally diversified stock and bond ETFs.

- Socially responsible portfolio consists of holdings that score well on environmental and social impact (note that investments may not meet standard requirements for this theme).

- Goldman Sachs Smart Beta portfolio that seeks to outperform the market.

- Income-focused all-bond portfolio made up of BlackRock ETFs.

- “Flexible Portfolio” weighted according to user preferences but created from the standard portfolio’s asset classes.

The accounts in Betterment are dynamically rebalanced when they begin to deviate from their goal allocations. Additionally, when a portfolio’s target date draws nearer, the portfolio becomes conserved with the primary aim of avoiding major losses and locking in gains.

Fidelity

With Fidelity Investments, portfolios are invested in proprietary no-fee funds directly managed by the company.

According to research, 0.5% of all portfolios on Fidelity are held in cash. Portfolio rebalancing is done twice a year. Rebalancing can occur in two instances:

- When the cash get to an internal limit of about 1%

- If the portfolio significantly drifts from its allocation target

Betterment Vs Fidelity: Account Types

Both Betterment and Fidelity offer a vast array of accounts from a retirement plan to taxable accounts. However, Betterment takes the lead in this category.

Betterment Accounts

- Traditional, Roth, SEP, and Rollover IRAs

- Individual and Joint taxable accounts

- Trust accounts

- High-interest savings accounts

Fidelity Accounts

- Individual and joint taxable accounts

- Traditional, Roth, SEP, and Rollover IRAs

Betterment Vs Fidelity: Minimum Deposit

In a divergent move, neither Fidelity nor Betterment requires a minimum deposit to open an account.

To invest in Fidelity all you need is $10, and that money is put in a short-term investment that doesn’t incur any advisory charge until it meets the threshold.

Betterment seems to share this threshold with Fidelity. However, it isn’t explicitly stated in any promotional materials.

Betterment Vs Fidelity: Retirement Planning

Betterment

Betterment allows you to connect to external accounts like your brokerage holding and bank accounts to offer you a much clearer picture of how your retirement savings journey is going.

Fidelity

You don’t get Betterment’s level of account syncing. But you will get a general picture of how you can reach your retirement goals in your IRA accounts.

Both platforms can keep you on track but Betterment has the edge as it provides you an overall picture with linked external accounts.

Betterment Vs Fidelity: Fees

Betterment

With Betterment, users have two plans to choose from:

- The Betterment Digital plan, which comes with a yearly fee of 0.25%. Users also don’t have to worry about having an investment account minimum.

- The Betterment Premium plan, which requires a $100,000 account minimum balance with a 0.40% yearly fee.

With the Digital plan, you get personalized advice on the assets you hold outside Betterment. You can also get guidance on life events such as retirement, having a child, or getting married. Additionally, you also get ETFs in the Betterment portfolios that come with management fees within the range of .07% and .15%.

Fidelity

Fidelity has a management fee of 0.35% for assets in portfolios valued at more than $50,000. There are no management fees for an account balance of less than $10,000. Fidelity charges a monthly subscription fee of $3 for accounts between $10,000 and $49,999.

The portfolios are created to hold a proprietary Fidelity no-fee mutual fund to ensure that users do not incur any additional fees.

Betterment Vs Fidelity: Accessibility and Features

Betterment, on the whole, has a wider range of features compared to Fidelity. This is because Fidelity was created to focus on your investments in the stock market rather than the entire financial picture. Betterment uses checking and savings accounts, which shows that it is evolving towards a more complete solely digital solution that manages all facets of your finances as well as investment management.

Betterment

Betterment offers its clients free financial planning tools, which can help provide a comprehensive analysis of their previous investments before they create an account. It also offers flexibility in its goals by providing goal planning resources such as coaching. The account interface is created to support enhanced portfolio flexibility.

Customers who want a bit more can get the premium plan that offers a financial advisor at any moment at no additional charge. It is important to note that the premium plan charges a .4% management fee over the 0.25% management fee charged by the standard plan.

Fidelity

Fidelity Investments offers a feature called cash sweep where any cash in an account gets moved into a money market. You can also get Fidelity consolidation, which is suitable for users with various accounts, including brokerage at Fidelity. This enables you to see all of your Fidelity-associated holdings on one screen.

There are also educational resources designed for users. The resources include classes, articles, and videos all published by the company.

By the way, how does a financial advisor differ from Robo-Advisor? The answer might surprise you.

Betterment Vs Fidelity: Additional Features

Betterment offers tax-loss harvesting to every taxable account. On the other hand, Fidelity doesn’t have tax-loss harvesting services since it only offers users its proprietary ETFs. This sets a practical limit on the number of tax purpose-associated substitutions.

As for security, both Fidelity and Betterment have advanced security features on their mobile apps and web platforms. Security features such as biometric logins and two-factor authentication are available on both platforms.

At this moment, Betterment doesn’t have the SIPC or Securities Investor Protection Corporation Insurance. However, the trades are cleared through Apex Clearing, a firm that has priority risk management tools in place.

On the flip side, Fidelity has a Customer Protection guarantee, which ensures that customers are reimbursed for losses as a result of unauthorized activities on their accounts. It also participates in SIPC and FDIC, which are asset protection programs. These programs ensure that any losses from an unexpected economic catastrophe are insured.

Overall, both platforms have various controls to protect not only your money but your data as well.

When it comes to customer service, Betterment customers can reach the company via email and phone from 9 am to 6 pm Eastern Time during the weekdays. If you have a Premium account on Betterment, you can get assistance from a certified financial planner anytime. But the service will cost you anything from $200 to $300 if you have a basic account.

As mentioned earlier, Fidelity only provides a digital account, so customers will have to get used to online support. There is a basic chat function that works 24/7. The automated chatbot can offer answers to basic questions.

There is also a FAQs section, but the answers are not very detailed. The only way to get clearer answers to your questions is to join the phone queue. Since there is only one way to talk to a human advisor, the waiting period can be a while. However, once an agent answers your call, you will get knowledgeable answers.

Conclusion

Overall, both Fidelity and Betterment are great choices for individuals searching for a Robo-advisor. The most effective way to make a choice is to go through each investment option, find out the features they provide, the fees, and of course, how their portfolios can align with your financial goals. You can also compare Betterment Vs Acorn or SoFi Vs Acorn by reading these articles.